Abans Finance PLC has announced best-ever results in FY21 with Rs. 356 million Profit After Tax (PAT), despite the turbulent period due to the COVID-19 pandemic.

This PAT is an increase of 246% from the profit for the corresponding period last year where PAT was only Rs. 103 million. The company carries a ‘A (lka)’credit rating from Fitch Ratings.

This result was the outcome of timely investments made in the past two-three years in technology, people and processes which enabled the company to continue operations with minimal delay despite several disruptions in the past year. The company is moving towards a paperless workplace with most transactions completed on tabs and through customised software that has been developed within the company.

In addition, the company made timely moves into alternative lending products during 2020/2021 and discontinued other loss-making products. As a result, the Income earning Asset Base (YOY) decreased slightly by 4.7% from Rs. 7.7 billion in 31 March 2020 to Rs. 7.4 billion in 31 March 2021. Company’s Total Asset Base (YOY) marked a slight growth of 2% from Rs. 9.1 billion as at 31 March 2020 to Rs. 9.2 billion as at 31 March 2021.

Further diversification of the lending portfolio into various sectors and geographic areas together with strategies used in managing the concentration risk has further stabilised the quality of the lending portfolio and facilitated in maintaining a healthy liquidity position. By setting the company KPIs in line with its long-term sustainability goals within a framework of balanced score card, management team is optimistic on sustainability of its profit momentum and growth in portfolio in the coming years.

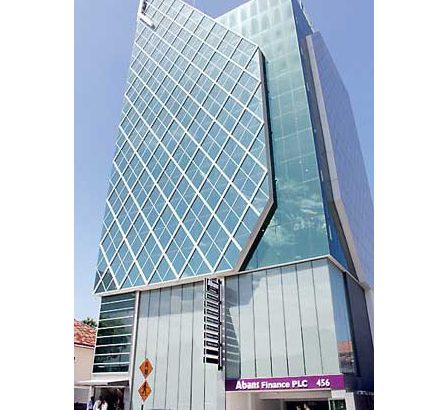

Abans Finance PLC is a principal member of the prestigious Abans Group, the renowned household name in Sri Lanka. Through the backing of the Abans Group and a strong management team led by CEO Dharshan Silva the company has been able to diversify its lending portfolio, reduce its funding cost and improve collections to record the best-ever performance in its 15 years of operation.