Abans Finance, a member of the Abans Group, has ended the financial year with a solid performance amidst challenging market conditions.

The company registered a pre-tax profit of Rs. 151.5 million for the period ended 31 March 2020, compared to Rs. 110.8 million recorded in the corresponding year, achieving a YoY growth of 37.1%.

This solid performance was made possible by focusing on introducing technology and credit scoring to loan origination, developing stronger collection practices and improving cost efficiencies across the organisation.

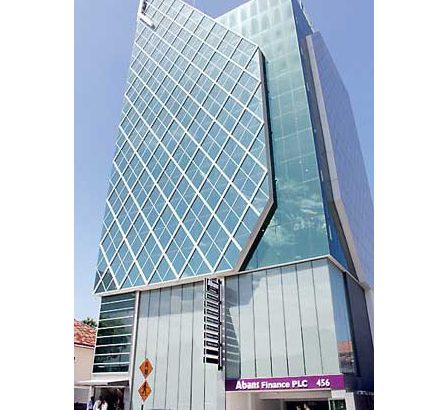

Abans Finance has also maintained a strong Capital Adequacy Ratio. As of 31 March 2020, the Risk Weighted Capital Adequacy Ratio stood at 11.21%, well above the required level of 10.5%, reflecting the Company’s focus on strengthening risk and stability. Abans Group is a leading Sri Lankan conglomerate with annual turnover of over Rs. 35 billion. Since 1968 Abans Groups’ sphere of influence has been growing and far-reaching, extending to every corner of Sri Lanka. Its presence in key industries, including retail, commercial real estate, manufacturing, logistics, environmental management, automobile and finance, has had a transformative impact on the Sri Lankan economy as a whole.

More recently, Fitch Ratings reaffirmed Abans Group’s National Long-Term Rating at ‘BBB+ (lka)’ reflecting the stability and the stature the Group has earned in the market.

Abans Finance’s principal lines of business include finance leasing, mortgage loans, personal loans, and acceptance of time and savings deposits. The company currently operates across the island with over 20 centres and is further backed by the over four hundred Abans PLC’s outlets island-wide.